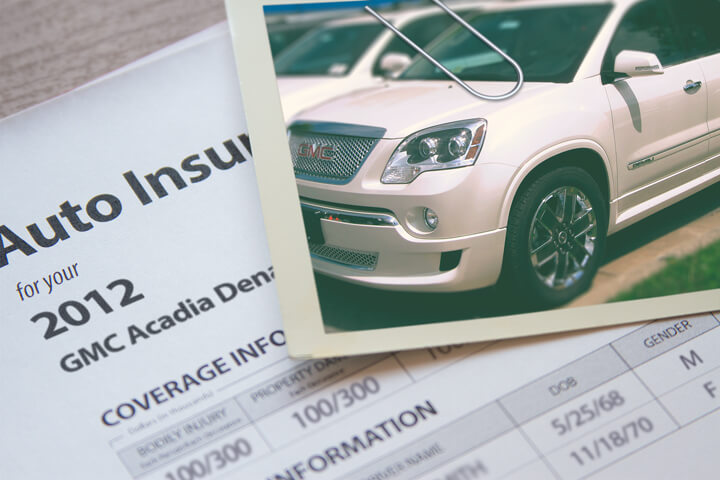

GMC Acadia insurance policy image courtesy of QuoteInspector.com

Do you need a better way to compare the cheapest GMC Acadia insurance in Baltimore? If you're looking for lower-cost insurance online, are you frustrated by the dozens of insurance companies in your area? Maryland consumers have such a vast assortment of companies available that it is a difficult situation to locate the lowest prices for GMC Acadia insurance in Baltimore. If you live there, you know that Baltimore is a good city to live in, but inflated insurance rates can make it nearly impossible for many drivers to be able to afford adequate coverage.

Do you need a better way to compare the cheapest GMC Acadia insurance in Baltimore? If you're looking for lower-cost insurance online, are you frustrated by the dozens of insurance companies in your area? Maryland consumers have such a vast assortment of companies available that it is a difficult situation to locate the lowest prices for GMC Acadia insurance in Baltimore. If you live there, you know that Baltimore is a good city to live in, but inflated insurance rates can make it nearly impossible for many drivers to be able to afford adequate coverage.

How to find low-cost rates for GMC Acadia insurance in Baltimore

The best way to get affordable GMC Acadia insurance in Baltimore is to make a habit of regularly comparing prices from providers who provide car insurance in Maryland.

- Step 1: Try to comprehend what coverages are included in your policy and the factors you can control to prevent high rates. Many factors that cause rate increases such as traffic tickets, fender benders, and a poor credit score can be improved by making minor driving habit or lifestyle changes.

- Step 2: Quote rates from independent agents, exclusive agents, and direct companies. Exclusive and direct companies can only give prices from a single company like GEICO or Farmers Insurance, while agents who are independent can provide price quotes for many different companies. Begin your rate comparison

- Step 3: Compare the new rate quotes to the premium of your current policy and see if you can save money. If you find better rates, make sure coverage is continuous and does not lapse.

The key thing to know about shopping around is to make sure you enter identical coverages on every quote request and and to get quotes from as many companies as possible. This guarantees an apples-to-apples comparison and many rates to choose from.

It's hard to fathom, but 70% of consumers have stayed with the same insurance company for over three years, and practically 40% of insurance customers have never taken the time to shop around. With the average insurance premium being $1,847, American drivers can cut their rates by $850 a year by just comparing quotes, but most just don't grasp the amount of money they would save if they switched to a more affordable policy.

This article will familiarize you with the most effective ways to compare rates and some tips to save money. If you have a policy now, you stand a good chance to be able to save money using these tips. But Maryland consumers need to learn the way insurance companies set your policy premium because it can help you find the best coverage.

Insurance policy discounts for GMC Acadia insurance in Baltimore

Companies that sell car insurance do not list every discount they offer in a way that's easy to find, so the list below contains some of the best known as well as the least known ways to save on insurance.

- Federal Government Employee - Simply working for the federal government could qualify for a slight premium decrease with select insurance companies.

- Telematics Data - Baltimore drivers who agree to allow driving data collection to scrutinize driving manner by installing a telematics device such as Progressive's Snapshot could save a few bucks if they have good driving habits.

- Multi-policy Discount - If you combine your auto and home policies with the same company you may save at least 10 to 15 percent or more.

- Home Ownership Discount - Just owning your own home can get you a discount since home ownership means you have a higher level of financial diligence.

- Buy New and Save - Insuring a new Acadia is cheaper since new vehicles have better safety ratings.

- More Vehicles More Savings - Having multiple vehicles with the same company qualifies for this discount.

- Service Members Pay Less - Having a family member in the military could trigger a small discount.

A little disclaimer on discounts, some credits don't apply to the entire policy premium. The majority will only reduce the cost of specific coverages such as liability and collision coverage. So when it seems like all those discounts means the company will pay you, it just doesn't work that way.

The information below visualizes the comparison of GMC Acadia car insurance costs with and without discounts applied to the rates. The data is based on a female driver, no violations or claims, Maryland state minimum liability limits, full coverage, and $100 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with marriage, multi-car, homeowner, claim-free, safe-driver, and multi-policy discounts applied.

The best insurance companies and some of their more popular discounts are outlined below.

- American Family offers discounts including defensive driver, early bird, Steer into Savings, mySafetyValet, multi-vehicle, bundled insurance, and good student.

- Farm Bureau discounts include multi-vehicle, renewal discount, youthful driver, good student, safe driver, and multi-policy.

- State Farm offers premium reductions for accident-free, student away at school, anti-theft, multiple autos, and Steer Clear safe driver discount.

- Travelers offers discounts for good student, multi-car, home ownership, save driver, and continuous insurance.

- The Hartford includes discounts for good student, bundle, defensive driver, vehicle fuel type, driver training, and anti-theft.

- GEICO may include discounts for federal employee, good student, driver training, defensive driver, and membership and employees.

- Progressive has discounts for homeowner, good student, multi-policy, online signing, online quote discount, multi-vehicle, and continuous coverage.

When comparing rates, check with every prospective company which discounts you qualify for. All car insurance discounts may not apply to policies in your area. If you would like to see a list of insurance companies who offer discounts in Maryland, click here to view.

When comparing insurance rates, know that making a lot of price comparisons increases your odds of finding more affordable rates.

The companies in the list below are our best choices to provide free quotes in Baltimore, MD. In order to find the cheapest auto insurance in Baltimore, we suggest you visit several of them to find the lowest auto insurance rates.

Rate information and statistics

The rate information shown below outlines estimates of rate quotes for GMC Acadia models. Understanding how insurance rates are determined can benefit drivers when making informed decisions.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Acadia SL 2WD | $236 | $448 | $458 | $28 | $138 | $1,308 | $109 |

| Acadia SL AWD | $270 | $448 | $458 | $28 | $138 | $1,342 | $112 |

| Acadia SLE 2WD | $270 | $448 | $458 | $28 | $138 | $1,342 | $112 |

| Acadia SLE AWD | $270 | $544 | $458 | $28 | $138 | $1,438 | $120 |

| Acadia SLT 2WD | $270 | $544 | $458 | $28 | $138 | $1,438 | $120 |

| Acadia SLT AWD | $304 | $544 | $458 | $28 | $138 | $1,472 | $123 |

| Get Your Own Custom Quote Go | |||||||

Data assumes single male driver age 50, no speeding tickets, no at-fault accidents, $250 deductibles, and Maryland minimum liability limits. Discounts applied include multi-policy, homeowner, claim-free, multi-vehicle, and safe-driver. Prices do not factor in specific zip code location which can revise premiums greatly.

Bad driving habits will cost you more

The information below highlights how traffic violations and at-fault accidents raise GMC Acadia insurance costs for each different age group. The prices are based on a single female driver, comprehensive and collision coverage, $1,000 deductibles, and no discounts are taken into consideration.

Learn How to Quote Auto Insurance for Less

Many things are part of the calculation when you quote your car insurance policy. Some are obvious like your driving record, but other criteria are less obvious such as your credit history or your financial responsibility.

- Lower coverage deductibles cost more - Deductibles for physical damage tell how much you are required to pay in the event of a claim. Insurance for physical damage, also called comprehensive and collision insurance, covers damage that occurs to your car. Some examples of covered claims are colliding with a stationary object, fire damage, and damage caused by road hazards. The more of the claim you're willing to pay, the lower your rates will be.

- Safer cars means lower prices - Vehicles with good safety scores can get you lower premiums. Highly rated vehicles have better occupant injury protection and lower injury rates translates directly to fewer claims and lower rates for you.

- Deter car thieves - Choosing a vehicle with advanced anti-theft systems can help bring down rates. Theft prevention features such as LoJack tracking devices, vehicle tamper alarm systems or GM's OnStar system can thwart auto theft.

- Keep premiums low by being claim-free - If you're an insured who likes to file claims you can pretty much guarantee higher premiums or even policy non-renewal. Auto insurance companies in Maryland provide the lowest premiums to policyholders who are claim-free. Insurance coverage is meant to be used in the event of claims that pose a financial burden.

- Rural vs Urban Areas - Being located in a small town is a good thing when it comes to auto insurance. Less people living in that area means a lower chance of having an accident and also fewer theft and vandalism claims. City drivers tend to have more aggressive driving styles and higher rates of accident claims. More time commuting translates into higher accident risk.

- Multiple policies with one company can save - Most major insurers give a discount to buyers who carry more than one policy, otherwise known as a multi-policy discount. The discount can be 10 percent or more. If you currently are using one company, consumers should still check prices from other companies to guarantee you are still saving the most. You may still be able to save even more than the discount by buying insurance from more than one company.

-

High performance equals high prices - The performance level of the car, truck or SUV you need insurance for makes a substantial difference in your rates. The lowest base rates tend to be for the lowest performance passenger vehicles, but that's not the only thing that factors into the final price.

The data below is based on a married male driver age 50, full coverage with $1000 deductibles, and no discounts or violations. It illustrates GMC Acadia insurance premiums compared to other vehicles that have a range of performances.

-

GMC Acadia insurance claim data - Insurers factor in insurance loss information when determining insurance rates. Vehicles that statistically have higher claim frequency or loss amount will have increased rates. The information below illustrates the historical loss data for GMC Acadia vehicles.

For each coverage category, the claim probability for all vehicles averaged together is equal to 100. Numbers that are below 100 suggest losses that are better than average, while numbers above 100 indicate a higher chance of having a claim or an increased likelihood of larger losses.

Auto Insurance Loss Data for GMC Acadia Models Vehicle Make and Model Collision Property Damage Comp Personal Injury Medical Payment Bodily Injury GMC Acadia 4dr 2WD 75 86 73 71 69 80 GMC Acadia 4dr 4WD 83 100 88 62 63 80 BETTERAVERAGEWORSEData Source: iihs.org (Insurance Institute for Highway Safety) for 2013-2015 Model Years

Do I need special coverages?

When choosing adequate coverage, there is no one size fits all plan. Your needs are unique to you.

These are some specific questions might point out if your insurance needs could use an agent's help.

- Does insurance cover damages from a DUI accident?

- Does coverage extend to Mexico or Canada?

- How can I get the company to pay a claim?

- Does liability extend to a camper or trailer?

- Am I covered when renting a car or should I buy coverage from the car rental agency?

- When should I remove my kid from my policy?

- How much will a speeding ticket raise my rates?

- Does low annual mileage earn a discount?

- Do I have coverage if my license is suspended?

- Do I have coverage when using my vehicle for my home business?

If you can't answer these questions then you might want to talk to a licensed agent. To find lower rates from a local agent, take a second and complete this form.

Local agents and auto insurance

Many drivers would rather get professional advice from a licensed agent and we recommend doing that One of the best bonuses of getting online price quotes is that you can obtain cheap auto insurance rates and still buy from a local agent. Buying from neighborhood insurance agencies is still important in Baltimore.

By using this simple form, your coverage information is immediately sent to participating agents in Baltimore who will gladly provide quotes for your business. You don't have to contact any insurance agencies since rate quotes are delivered to you. You can find the lowest rates and an insurance agent to talk to. If you want to get a rate quote from a specific auto insurance provider, you would need to visit that company's website and submit a quote form there.

By using this simple form, your coverage information is immediately sent to participating agents in Baltimore who will gladly provide quotes for your business. You don't have to contact any insurance agencies since rate quotes are delivered to you. You can find the lowest rates and an insurance agent to talk to. If you want to get a rate quote from a specific auto insurance provider, you would need to visit that company's website and submit a quote form there.

If you want to buy auto insurance from an insurance agent, it's important to understand the different types of agents and how they function. Agents may be either independent (non-exclusive) or exclusive.

Independent Insurance Agents

Independent agents can quote rates with many companies and that allows them to write policies with multiple insurance companies and find you the best rates. If they quote lower rates, they simply switch companies in-house and that require little work on your part. When comparing auto insurance rates, you will want to get several quotes from a few independent agents for the best price selection. They also have the ability to place coverage with companies you've never heard of which may have better rates.

The following are independent agents in Baltimore who may provide comparison quotes.

- Mason and Carter Inc

23 South St - Baltimore, MD 21202 - (410) 539-6767 - View Map - Nationwide Insurance: Bruce Cohee Agency Inc

502 Baltimore Ave - Towson, MD 21204 - (410) 823-8777 - View Map - Austen's Insurance Inc

3407 Eastern Blvd - Baltimore, MD 21220 - (410) 686-4700 - View Map

Exclusive Agencies

Exclusive agents can only quote rates from one company and some examples include Allstate, State Farm and Farm Bureau. Exclusive agents cannot provide other company's prices so they have no alternatives for high prices. They receive extensive training in insurance sales which helps them sell insurance even at higher premiums. Some consumers prefer to choose to use an exclusive agent mainly due to the brand name rather than having low rates.

Below are Baltimore exclusive agents that are able to give rate quotes.

- Kennedy Ins Agency - Progressive Insurance

410 Ingleside Ave - Baltimore, MD 21214 - (410) 719-6006 - View Map - Tamara Thomson - State Farm Insurance Agent

7823 Wise Ave - Baltimore, MD 21222 - (410) 282-7283 - View Map - Eve Hamper - State Farm Insurance Agent

1118 Light St A - Baltimore, MD 21230 - (410) 528-8900 - View Map

Picking the best insurance agency requires you to look at more than just a low price. Here are some questions you might want to ask.

- Does the company allow you to choose your own collision repair facility?

- Is there a Errors and Omissions policy in force?

- Do they specialize in personal lines coverage in Baltimore?

- Do they reduce claim amounts on high mileage vehicles?

- Is the agent CPCU or CIC certified?

- Who are their largest clients?

- Which members of your family are coverage by the policy?

- How many years have they been established?

Car insurance in Maryland serves several purposes

Despite the high cost of buying insurance for a GMC Acadia in Baltimore, maintaining insurance is required in Maryland but also provides important benefits.

- Just about all states have mandatory insurance requirements which means it is punishable by state law to not carry specific minimum amounts of liability insurance coverage in order to drive the car legally. In Maryland these limits are 30/60/15 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $15,000 of property damage coverage.

- If you took out a loan on your Acadia, more than likely the lender will make it a condition of the loan that you buy full coverage to guarantee loan repayment. If coverage lapses or is canceled, the lender will be forced to insure your GMC at a much higher premium rate and force you to reimburse them for the much more expensive policy.

- Car insurance preserves both your assets and your vehicle. It will also pay for hospital and medical expenses that are the result of an accident. Liability insurance will also pay to defend you if you cause an accident and are sued. If your car is damaged in a storm or accident, your policy will cover the damage repairs after a deductible is paid.

The benefits of carrying adequate insurance outweigh the cost, specifically if you ever have a liability claim. According to a recent study, the average American driver overpays as much as $865 each year so we recommend shopping around at every policy renewal to ensure rates are competitive.

Persistence pays off

As you quote Baltimore car insurance, it's not a good idea to sacrifice coverage to reduce premiums. In many cases, drivers have reduced liability coverage limits only to regret at claim time they didn't have enough coverage. Your aim should be to buy the best coverage you can find at an affordable rate and still be able to protect your assets.

Throughout this article, we presented a lot of information how to find affordable GMC Acadia insurance in Baltimore. It's most important to understand that the more rate quotes you have, the better chance you'll have of finding affordable Baltimore car insurance quotes. Consumers may even find the most savings is with some of the lesser-known companies.

Drivers leave their current company for many reasons like unfair underwriting practices, not issuing a premium refund, poor customer service or even questionable increases in premium. No matter why you want to switch, finding a new insurance company can be easier than you think.

How to find discount GMC Acadia insurance in Baltimore

To save the most money, the best way to get more affordable car insurance rates in Baltimore is to do a yearly price comparison from companies in Maryland. You can compare rates by completing these steps.

First, try to comprehend what coverages are included in your policy and the steps you can take to prevent expensive coverage. Many things that cause rate increases such as traffic citations, accidents, and an imperfect credit rating can be improved by making small lifestyle or driving habit changes.

Second, obtain price quotes from direct carriers, independent agents, and exclusive agents. Exclusive agents and direct companies can give quotes from a single company like GEICO or Allstate, while agents who are independent can provide prices for a wide range of companies.

Third, compare the price quotes to your existing rates to see if you can save by switching companies. If you can save some money and make a switch, ensure coverage does not lapse between policies.

Fourth, notify your current company of your decision to cancel the current policy and submit a down payment along with a signed application for your new coverage. As soon as coverage is bound, keep the new proof of insurance paperwork in your vehicle.

The most important part of this process is to try to compare similar deductibles and liability limits on every quote request and and to analyze all possible companies. Doing this guarantees an accurate price comparison and the best price selection.

Helpful articles

- Should I Purchase an Umbrella Liability Policy? (Insurance Information Institute)

- Who Has Cheap Auto Insurance for Uninsured Drivers in Baltimore? (FAQ)

- Who Has the Cheapest Auto Insurance Rates for Government Employees in Baltimore? (FAQ)

- How Much are Car Insurance Quotes for Ride Shares in Baltimore? (FAQ)

- Who Has the Cheapest Baltimore Car Insurance Quotes for a Toyota Highlander? (FAQ)

- Who Has Affordable Baltimore Auto Insurance for a Nissan Rogue? (FAQ)

- Who Has the Cheapest Car Insurance Rates for Immigrants in Baltimore? (FAQ)

- Tools for Teen Driving Safety (State Farm)

- Car Insurance: When not to Skimp (BankRate.com)

- How to Avoid Buying a Flooded Car (Insurance Information Institute)