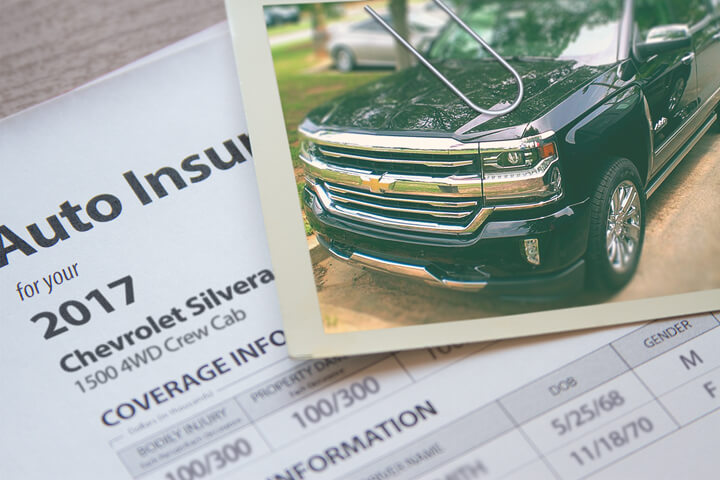

Chevy Silverado insurance image courtesy of QuoteInspector.com

If saving the most money is your goal, then the best way to find affordable quotes for Chevy Silverado insurance in Baltimore is to start comparing rates regularly from providers who sell insurance in Maryland.

If saving the most money is your goal, then the best way to find affordable quotes for Chevy Silverado insurance in Baltimore is to start comparing rates regularly from providers who sell insurance in Maryland.

- Spend some time learning about car insurance and the factors you can control to prevent expensive coverage. Many rating factors that result in higher prices such as distracted driving and a less-than-favorable credit rating can be eliminated by making minor changes to your lifestyle.

- Compare rates from exclusive agents, independent agents, and direct providers. Exclusive agents and direct companies can provide rates from a single company like Progressive and State Farm, while independent agents can provide price quotes for a wide range of insurance providers. Start a quote

- Compare the new rates to your current policy premium to see if a cheaper price is available. If you find a lower rate and change companies, ensure coverage does not lapse between policies.

- Notify your company or agent to cancel your current policy. Submit a completed policy application and payment to the new insurer. Make sure you place your new proof of insurance certificate along with the vehicle's registration papers.

A tip to remember is to try to use similar limits and deductibles on every quote request and and to compare as many auto insurance providers as possible. Doing this guarantees a level playing field and the best rate selection.

It's a fact that insurance companies want to prevent you from shopping around. Insureds who shop around for the cheapest rate are inclined to switch auto insurance companies because there is a good chance of finding a more affordable policy. A recent survey revealed that consumers who make a habit of shopping around saved $72 a month as compared to drivers who don't make a habit of comparing rates.

If finding discount rates on car insurance is your objective, knowing how to quote and compare coverages can save time and make the process easier.

If you have a policy now or need new coverage, use these techniques to buy cheaper insurance while maximizing coverage. Choosing the best rates in Baltimore is much easier if you know where to start. Smart buyers only need to know the most efficient way to compare price quotes online.

The quickest way to compare car insurance company rates for Chevy Silverado insurance in Baltimore is to realize all the major auto insurance companies will pay a fee to give you rate quotes. To start a quote, the only thing you need to do is take a few minutes to give details such as how much school you completed, how your vehicles are used, if it has an alarm system, and how many miles driven. Your information gets sent immediately to multiple companies and you get price estimates with very little delay.

To find the cheapest car insurance rates, click here and complete the form.

The companies shown below are our best choices to provide free quotes in Baltimore, MD. If multiple companies are listed, it's highly recommended you get rate quotes from several of them to find the lowest car insurance rates.

Statistics and details

The premium information shown next covers detailed analysis of coverage costs for Chevy Silverado models. Learning as much as possible about how prices are established can help drivers make smart choices when selecting a policy.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Silverado LS Regular Cab 2WD | $146 | $282 | $518 | $30 | $156 | $1,132 | $94 |

| Silverado LS Regular Cab 4WD | $146 | $282 | $458 | $28 | $138 | $1,052 | $88 |

| Silverado LT Regular Cab 2WD | $166 | $342 | $518 | $30 | $156 | $1,212 | $101 |

| Silverado LT Regular Cab | $166 | $342 | $518 | $30 | $156 | $1,212 | $101 |

| Silverado LS Extended Cab 4WD | $166 | $342 | $458 | $28 | $138 | $1,132 | $94 |

| Silverado LT Extended Cab 4WD | $166 | $342 | $458 | $28 | $138 | $1,132 | $94 |

| Silverado LT Extended Cab 2WD | $166 | $342 | $518 | $30 | $156 | $1,212 | $101 |

| Silverado LS Extended Cab 2WD | $166 | $342 | $518 | $30 | $156 | $1,212 | $101 |

| Silverado LT Crew Cab 4WD | $188 | $404 | $458 | $28 | $138 | $1,216 | $101 |

| Silverado LS Crew Cab 2WD | $188 | $404 | $518 | $30 | $156 | $1,296 | $108 |

| Silverado LS Crew Cab 4WD | $188 | $404 | $458 | $28 | $138 | $1,216 | $101 |

| Silverado LT Crew Cab 2WD | $188 | $404 | $518 | $30 | $156 | $1,296 | $108 |

| Silverado LTZ Extended Cab 2WD | $188 | $404 | $518 | $30 | $156 | $1,296 | $108 |

| Silverado LTZ Extended Cab 4WD | $188 | $404 | $458 | $28 | $138 | $1,216 | $101 |

| Silverado LTZ Crew Cab 2WD | $188 | $404 | $518 | $30 | $156 | $1,296 | $108 |

| Silverado LTZ Crew Cab 4WD | $188 | $404 | $458 | $28 | $138 | $1,216 | $101 |

| Silverado Crew Cab Hybrid 2WD | $188 | $464 | $458 | $28 | $138 | $1,276 | $106 |

| Silverado Crew Cab Hybrid 4WD | $210 | $464 | $458 | $28 | $138 | $1,298 | $108 |

| Get Your Own Custom Quote Go | |||||||

Above prices assume single male driver age 50, no speeding tickets, no at-fault accidents, $1000 deductibles, and Maryland minimum liability limits. Discounts applied include multi-policy, homeowner, multi-vehicle, safe-driver, and claim-free. Information does not factor in your specific Baltimore location which can change auto insurance rates significantly.

The illustration below illustrates how your deductible choice and can change Chevy Silverado premium costs for each different age group. The costs are based on a single male driver, full coverage, and no additional discounts are factored in.

Drive responsibly or pay higher rates

The example below highlights how speeding tickets and accidents impact Chevy Silverado yearly insurance costs for different ages of insureds. The costs are based on a married male driver, full physical damage coverage, $250 deductibles, and no discounts are factored in.

Comparison of full coverage and liability-only policies

The illustration below illustrates the difference between Chevy Silverado insurance costs with and without full coverage. Data assumes no accidents, no driving violations, $100 deductibles, drivers are not married, and no policy discounts are applied.

Should you pay for full coverage or liability only?

There is no set rule to exclude comp and collision coverage, but there is a general school of thought. If the yearly cost for physical damage coverage is more than around 10% of the replacement cost of your vehicle minus the policy deductible, then it might be time to buy liability only.

For example, let's assume your Chevy Silverado replacement cost is $7,000 and you have $1,000 policy deductibles. If your vehicle is damaged in an accident, the most your company would pay you is $6,000 after paying your deductible. If you are paying in excess of $600 a year for your policy with full coverage, then it might be time to buy liability only.

There are some cases where eliminating full coverage is not a good plan. If you haven't paid off your loan, you have to keep full coverage to protect the lienholder's interest in the vehicle. Also, if you can't afford to buy a different vehicle in case of an accident, you should not opt for liability only.

Slash rates with these money saving discounts

Companies don't list all their discounts in an easy-to-find place, so the next list breaks down both well-publicized as well as the least known savings tricks you should be using when you buy Baltimore car insurance online. If you do not double check each discount you qualify for, you are throwing money away.

- E-sign - Many insurance companies will discount your bill up to fifty bucks for completing your application over the internet.

- Buy New and Save - Buying a new car model can cost up to 25% less compared to insuring an older model.

- Claim Free - Baltimore drivers who stay claim-free pay less as opposed to accident-prone drivers.

- Multiple Cars - Insuring primary and secondary vehicles with the same company can get a discount for every vehicle.

- Seat Belts Save more than Lives - Requiring all passengers to use a seat belt can save a little off the PIP or medical payment premium.

- Auto/Home Discount - If you have multiple policies with the same insurance company you could get a discount of at least 10 to 15 percent or more.

- Waiver for an Accident - Not really a discount, but some insurance companies will allow you to have one accident before they charge you more for coverage as long as you don't have any claims before the accident.

Discounts lower rates, but most discounts do not apply to your bottom line cost. Most only reduce the price of certain insurance coverages like comprehensive or collision. So when it seems like it's possible to get free car insurance, companies wouldn't make money that way.

The illustration below visualizes the comparison of Chevy Silverado car insurance costs with and without discounts. The costs are based on a male driver, no violations or accidents, Maryland state minimum liability limits, comp and collision included, and $1,000 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with claim-free, multi-policy, homeowner, multi-car, marriage, and safe-driver discounts applied.

If you would like to view providers that offer multiple discounts in Baltimore, click this link.

Car insurance does more than just protect your car

Despite the high cost, car insurance may be required and benefits you in several ways.

First, the majority of states have minimum mandated liability insurance limits which means it is punishable by state law to not carry specific limits of liability if you don't want to risk a ticket. In Maryland these limits are 30/60/15 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $15,000 of property damage coverage.

Second, if you have a loan on your car, it's guaranteed your bank will require you to buy insurance to ensure they get paid if you total the vehicle. If the policy lapses, the lender may have to buy a policy to insure your Chevy for a much higher rate and require you to pay a much higher amount than you were paying before.

Third, car insurance protects not only your Chevy but also your financial assets. It will also cover medical bills for you, any passengers, and anyone injured in an accident. Liability coverage will also pay for a defense attorney if anyone sues you for causing an accident. If mother nature or an accident damages your car, comprehensive and collision coverage will pay all costs to repair after the deductible has been paid.

The benefits of buying car insurance are definitely more than the cost, particularly when you have a large claim. An average driver in America is currently overpaying as much as $700 annually so it's important to compare rates at every renewal to ensure rates are competitive.

Best auto insurance company in Maryland

Picking a highly-rated company can be a challenge considering how many choices there are in Maryland. The company information in the lists below could help you select which car insurance providers to look at shopping your coverage with.

| Company | Value | Customer Service | Claims | Customer Satisfaction | A.M Best Rating | Overall Score |

|---|---|---|---|---|---|---|

| Travelers | 93 | 98 | 99 | 88% | A++ | 95.1 |

| USAA | 83 | 99 | 100 | 91% | A++ | 94.1 |

| Mercury Insurance | 97 | 96 | 88 | 89% | A+ | 93.4 |

| AAA Insurance | 91 | 95 | 92 | 90% | A | 93.3 |

| Nationwide | 85 | 95 | 97 | 89% | A+ | 92.4 |

| Allstate | 77 | 100 | 97 | 88% | A+ | 90.7 |

| State Farm | 80 | 94 | 96 | 88% | A++ | 90.6 |

| The Hartford | 88 | 93 | 91 | 87% | A+ | 90.4 |

| Safeco Insurance | 91 | 95 | 85 | 88% | A | 90.2 |

| Progressive | 88 | 94 | 83 | 88% | A+ | 90.1 |

| American Family | 91 | 86 | 95 | 83% | A | 89.7 |

| Esurance | 86 | 90 | 94 | 90% | A+ | 89.5 |

| The General | 86 | 93 | 89 | 84% | A- | 88.2 |

| GEICO | 79 | 89 | 95 | 87% | A++ | 87.8 |

| Titan Insurance | 86 | 82 | 92 | 86% | A+ | 86.5 |

| 21st Century | 86 | 82 | 90 | 84% | A | 86.4 |

| Liberty Mutual | 79 | 87 | 95 | 78% | A | 85.3 |

| Farmers Insurance | 77 | 80 | 80 | 84% | A | 80.3 |

| Compare Rates Now Go | ||||||

Data Source: Insure.com Best Car Insurance Companies

Local Baltimore car insurance agents and car insurance

Some consumers just prefer to talk to an insurance agent and that is recommended in a lot of cases Professional agents are trained to spot inefficiencies and help submit paperwork. The best thing about comparing insurance prices online is the fact that you can find better rates and still choose a local agent.

Once you complete this short form, the coverage information is immediately sent to agents in your area who will return price quotes to get your business. There is no reason to search for any insurance agencies because quoted prices will be sent directly to you. If you need to compare prices from one company in particular, feel free to go to their quote page and submit a quote form there.

Picking the best insurance company should include more criteria than just the quoted price. These are some questions your agent should answer.

- Are aftermarket or OEM parts used to repair vehicles?

- Do they review policy coverages at every renewal?

- Does the company have a local claim office in Baltimore?

- Is their price quote a firm figure or are their hidden costs?

- Do they have designations such as AIC, CPCU, or CIC?

- Are glass claims handled on-site or do you have to take your vehicle to a repair shop?

- Is the agency covered by Errors and Omissions coverage?

When searching for a reputable insurance agent or broker, it can be helpful to understand the different types of agents that differ in how they can insure your vehicles. Insurance agencies in Baltimore can be categorized as either independent (non-exclusive) or exclusive. Either type can properly insure your vehicles, but we need to point out how they are different since it may influence your agent selection.

Exclusive Insurance Agents

These type of agents can only place business with one company and some examples include American Family, State Farm, and AAA. Exclusive agents cannot shop your coverage around so you need to shop around if the rates are high. They are very knowledgeable on their company's products which helps offset the inability to provide other markets.

Below are exclusive agencies in Baltimore who can help you get price quote information.

Tom Nash - State Farm Insurance Agent

454 E Fort Ave - Baltimore, MD 21230 - (410) 727-4545 - View Map

John Stein - State Farm Insurance Agent

6630 Baltimore National Pike #100b - Baltimore, MD 21228 - (410) 744-7733 - View Map

GEICO Insurance Agent

7915 Belair Rd - Baltimore, MD 21236 - (410) 882-8200 - View Map

Independent Car Insurance Agents

Independent insurance agents do not sell for just one brand so as a result can place your coverage amongst many companies enabling the ability to shop coverage around. To move your coverage to a new company, the agent simply finds a different carrier and you can keep the same agent. If you need lower rates, it's a good idea to include price quotes from multiple independent agents to get the best comparison.

The following is a short list of independent agencies in Baltimore that can give you price quotes.

Lambert Insurance Inc

1826 Woodlawn Dr # 6 - Baltimore, MD 21207 - (410) 265-7850 - View Map

Luray Insurance of Baltimore

1726 Reisterstown Rd #220 - Baltimore, MD 21208 - (410) 602-2636 - View Map

Mason and Carter Inc

23 South St - Baltimore, MD 21202 - (410) 539-6767 - View Map

After getting positive responses to all your questions as well as affordable Chevrolet Silverado insurance rates in Baltimore quotes, you may have found an auto insurance agent that meets the criteria to adequately provide car insurance.