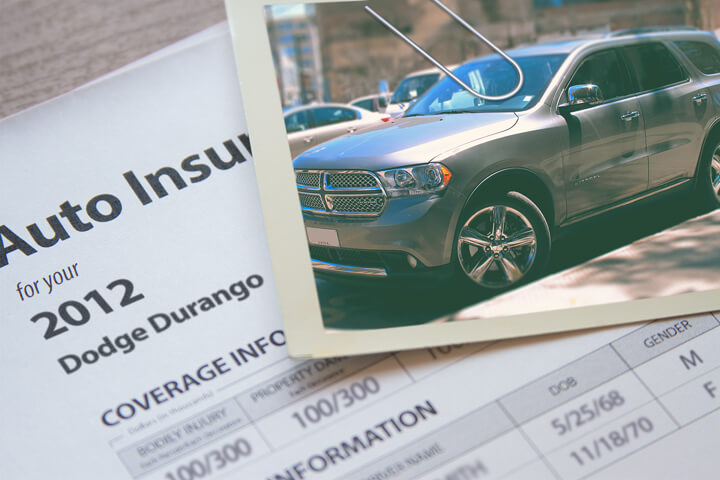

Dodge Durango insurance image courtesy of QuoteInspector.com

The most effective way to find the cheapest price for car insurance rates is to make a habit of comparing prices annually from insurers that insure vehicles in Baltimore. Rate comparisons can be done by following these guidelines.

The most effective way to find the cheapest price for car insurance rates is to make a habit of comparing prices annually from insurers that insure vehicles in Baltimore. Rate comparisons can be done by following these guidelines.

- First, spend a few minutes and learn about the coverage provided by your policy and the steps you can take to lower rates. Many policy risk factors that increase rates like tickets, at-fault accidents, and an unacceptable credit history can be eliminated by making minor changes in your lifestyle.

- Second, compare rates from direct, independent, and exclusive agents. Direct companies and exclusive agencies can only give rate quotes from a single company like GEICO or Allstate, while independent agencies can quote rates from multiple insurance companies.

- Third, compare the price quotes to the price on your current policy to see if a cheaper price is available in Baltimore. If you find a better price, make sure coverage is continuous and does not lapse.

- Fourth, provide notification to your current company of your decision to cancel your existing policy and submit payment along with a signed and completed policy application for your new policy. Once the application is submitted, store the certificate of insurance in an easily accessible location in your vehicle.

One thing to remember is to use similar deductibles and liability limits on every quote request and and to analyze as many carriers as you can. Doing this ensures an accurate price comparison and a complete rate analysis.

It's safe to conclude that insurance companies want to keep you from comparing rates. Drivers who shop around for cheaper price quotes are likely to switch companies because they have good chances of finding a policy with better rates. A survey found that people who regularly compared rates saved an average of $70 a month compared to policyholders who never shopped around for better prices.

If finding the lowest rates on insurance in Baltimore is why you're reading this, then having some knowledge of how to get free comparison quotes and analyze insurance premiums can help simplify the process.

The are a couple different ways to obtain and compare prices from all the different companies. The best way to lower the rate you pay for Dodge Durango insurance is to use the internet to compare rates.

When comparing insurance rates, know that comparing more prices will enable you to find the best offered rates. Some insurance companies are not set up to provide Baltimore Durango insurance quotes online, so it's recommended that you also compare rates from those companies as well.

The following companies are our best choices to provide quotes in Baltimore, MD. In order to find the best car insurance in Baltimore, it's a good idea that you click on several of them to get the best price comparison.

Discounts can help lower rates on Dodge Durango insurance in Baltimore

Some companies don't always advertise every discount they offer in a way that's easy to find, so we took the time to find a few of the more common and the more hidden discounts you could be receiving when you buy Baltimore auto insurance online.

- Life Insurance Discount - Some insurance companies give a break if you buy a life policy as well.

- Defensive Driver Discounts - Taking part in a safe driver course is a good idea and can lower rates if your company offers it.

- Cautious Drivers - Safe drivers can save as much as half off their rates than less cautious drivers.

- Passive Restraint Discount - Options like air bags or automatic seat belts could see savings of 25 to 30%.

- Military Rewards - Being deployed in the military could be rewarded with lower rates.

- Government Employee Discount - Having worked for a branch of the government may reduce rates when you quote Baltimore auto insurance with select insurance companies.

- Good Student Discount - Maintaining excellent grades may save you up to 25%. You can use this discount normally up until you turn 25.

Please keep in mind that most of the big mark downs will not be given to the entire cost. A few only apply to specific coverage prices like medical payments or collision. Even though the math looks like all the discounts add up to a free policy, company stockholders wouldn't be very happy.

A list of companies and some of their more popular discounts are detailed below.

- GEICO offers discounts including driver training, seat belt use, multi-policy, daytime running lights, emergency military deployment, five-year accident-free, and anti-theft.

- Auto-Owners Insurance offers discounts for anti-theft, good student, multi-policy, mature driver, paid in full, and air bags.

- American Family includes discounts for early bird, good driver, Steer into Savings, accident-free, mySafetyValet, and multi-vehicle.

- Esurance discounts include safety device, online quote, homeowner, multi-policy, and renters.

- Progressive has savings for online signing, continuous coverage, multi-vehicle, homeowner, multi-policy, good student, and online quote discount.

- State Farm has discounts for safe vehicle, student away at school, good driver, driver's education, good student, multiple autos, and multiple policy.

- AAA policyholders can earn discounts including good student, multi-car, good driver, multi-policy, education and occupation, and pay-in-full.

If you need low cost Baltimore auto insurance quotes, ask every prospective company the best way to save money. Some discounts may not be offered everywhere. For a list of insurance companies with the best discounts in Baltimore, follow this link.

How Insurers Determine Dodge Durango Insurance Prices

Lots of factors are part of the equation when pricing auto insurance. Some factors are common sense like an MVR report, but other criteria are less apparent such as whether you are married or how financially stable you are. One of the most helpful ways to save on auto insurance is to to have a grasp of the different types of things that play a part in calculating the price you pay for auto insurance. If you have a feel for what impacts premium levels, this empowers consumers to make smart changes that can earn you lower auto insurance prices.

Cars with good safety ratings save money - Cars with high safety ratings are cheaper to insure. Safer cars reduce occupant injuries and fewer injuries means your insurance company pays less which can result in lower premiums. If your Dodge Durango is rated at a minimum an "acceptable" rating on the Insurance Institute for Highway Safety website or four stars on the National Highway Traffic Safety Administration website it may be receiving lower rates.

Rates increase with driving citations - Even one chargeable violation could increase your next policy renewal by as much as thirty percent. Good drivers get better rates as compared to careless drivers. Drivers who have license-revoking citations like DUI or reckless driving may need to submit a SR-22 form with their state's department of motor vehicles in order to keep their license.

Drive a fast car and pay more - The performance level of the vehicle you are buying insurance for makes a significant difference in your auto insurance rates. The cheapest rates will generally be found on the lowest performance passenger cars, but that's not the only thing that factors into the final price.

Cheaper rates with high comp and collision deductibles - Physical damage insurance, otherwise known as comp (or other than collision) and collision, protects your Dodge from damage. Some examples of covered claims could be a windshield shattered by a rock, flood damage, and damage from a fallen tree branch. The deductibles you choose define how much you are required to spend before your auto insurance pays a claim. The higher the amount the insured has to pay upfront, the better rate you will receive.

Avoid policy lapses - Driving without insurance coverage in place is a misdemeanor and any future policy may cost more because you let your insurance coverage expire. Not only will you pay more, not being able to provide proof of insurance may earn you a steep fine or even jail time.

Dodge Durango claim data - Insurance companies take into consideration insurance loss statistics for every vehicle to help determine the price you pay. Models that have a higher amount or frequency of claims will cost more for coverage. The next table shows the insurance loss data used by companies for Dodge Durango vehicles.

For each insurance policy coverage type, the claim amount for all vehicles combined as an average is equal to 100. Numbers shown that are under 100 mean the vehicle has better than average losses, while values over 100 indicate more frequent losses or an increased likelihood of larger losses.

| Vehicle Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Dodge Durango 4dr 2WD | 88 | 110 | 91 | 104 | 90 | 100 |

| Dodge Durango 4dr 4WD | 90 | 115 | 97 | 92 | 93 | 102 |

Data Source: Insurance Institute for Highway Safety for 2013-2015 Model Years