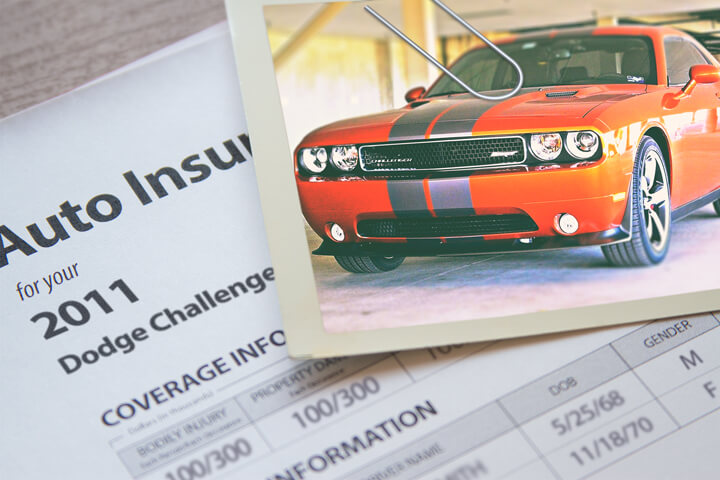

Dodge Challenger insurance image courtesy of QuoteInspector.com

Smart shoppers know that car insurance companies want to keep you from comparing rates. Drivers who shop around once a year are highly likely to switch to a new company because they have good chances of finding lower prices. A recent survey found that consumers who compared price quotes annually saved an average of $850 each year compared to people who don't regularly compare prices.

Smart shoppers know that car insurance companies want to keep you from comparing rates. Drivers who shop around once a year are highly likely to switch to a new company because they have good chances of finding lower prices. A recent survey found that consumers who compared price quotes annually saved an average of $850 each year compared to people who don't regularly compare prices.

If finding low prices for Dodge Challenger insurance is why you're here, then having an understanding of how to get rate quotes and compare auto insurance can help you succeed in saving money.

If saving money is your primary concern, then the best way to find affordable quotes for Dodge Challenger insurance is to start doing a yearly price comparison from insurance carriers that sell auto insurance in Baltimore.

- Step 1: Take a few minutes and learn about car insurance and the things you can change to prevent expensive coverage. Many rating criteria that drive up the price such as speeding and your credit history can be rectified by improving your driving habits or financial responsibility.

- Step 2: Compare price quotes from independent agents, exclusive agents, and direct companies. Exclusive and direct companies can provide rates from a single company like Progressive or Allstate, while independent agencies can give you price quotes for a wide range of companies.

- Step 3: Compare the price quotes to your current policy premium to determine if you can save on Challenger insurance in Baltimore. If you find a lower rate quote and switch companies, make sure there is no lapse between the expiration of your current policy and the new one.

- Step 4: Notify your agent or company to cancel your current policy. Submit a completed policy application and payment to your new carrier. Make sure you place the new certificate verifying coverage with your vehicle's registration.

The key thing to know about shopping around is to use the same deductibles and limits on each price quote and and to analyze as many car insurance companies as possible. This guarantees a fair price comparison and the best rate selection.

To find the best insurance prices, there are several ways to compare rate quotes from many insurance companies in Maryland. By far the easiest way to find the lowest Dodge Challenger rates is to perform an online rate comparison.

Online shopping is fast and free, and it makes it obsolete to actually drive to and from local Baltimore insurance agencies. Quoting Dodge Challenger insurance online makes this unnecessary unless you require the extra assistance of a local agency. If you prefer, some companies allow you to price shop your coverage online and still use a local agent. When comparison shopping, comparing a wide range of rates helps increase your odds of locating better pricing.

The following companies are our best choices to provide price quotes in Baltimore, MD. To locate the cheapest auto insurance in MD, we recommend you compare several of them to get the cheapest price.

Lower your insurance rates with discounts

Companies don't necessarily list every discount very well, so the list below contains both the well known as well as some of the hidden discounts that you may qualify for.

- Accident Forgiveness Coverage - This one isn't a discount, but a few companies such as State Farm and Allstate allow you one accident without getting socked with a rate hike with the catch being you have to be claim-free before the accident.

- Telematics Data - Baltimore drivers who agree to allow their insurance company to scrutinize driving patterns by using a telematics device in their vehicle such as Progressive's Snapshot and State Farm's In-Drive may see discounts if they exhibit good driving behavior.

- Senior Citizen Rates - Mature drivers may qualify for lower premium rates.

- Bundle and Save - When you have multiple policies with one company you will save approximately 10% to 15%.

- Professional Memberships - Being in qualifying employment or professional organizations can get you a small discount on insurance.

- Safe Driver Discount - Safe drivers may save up to 50% more compared to rates paid by drivers with frequent claims.

- Discount for Swiching Early - Some larger companies reward drivers for signing up prior to the expiration date on your current Challenger insurance policy. You may see this discount when you get Baltimore auto insurance quotes online.

- Drivers Ed for Students - Teen drivers should successfully complete driver's ed class as it can save substantially.

- Safety Course Discount - Taking a class that teaches driver safety techniques could save 5% or more and easily pay for the cost of the class.

Drivers should understand that most discount credits are not given to the entire cost. Some only apply to the price of certain insurance coverages like medical payments or collision. Even though it may seem like you would end up receiving a 100% discount, it's just not the way it works.

The example below illustrates the difference between Dodge Challenger car insurance rates with and without discounts applied to the policy premium. The prices are based on a female driver, a clean driving record, no claims, Maryland state minimum liability limits, comp and collision included, and $1,000 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with marriage, multi-policy, claim-free, multi-car, homeowner, and safe-driver discounts applied.

A list of companies and a summarized list of policyholder discounts can be read below.

- Progressive may offer discounts for online quote discount, continuous coverage, good student, multi-vehicle, and online signing.

- MetLife offers premium reductions for multi-policy, good student, accident-free, defensive driver, claim-free, good driver

- Mercury Insurance includes discounts for multi-car, multi-policy, age of vehicle, good driver, annual mileage, type of vehicle, and professional/association.

- Nationwide has discounts for business or organization, easy pay, anti-theft, accident-free, family plan, and good student.

- GEICO may include discounts for anti-lock brakes, daytime running lights, good student, multi-vehicle, and membership and employees.

- AAA may have discounts that include anti-theft, AAA membership discount, good driver, pay-in-full, multi-car, good student, and education and occupation.

When getting free Baltimore auto insurance quotes, it's a good idea to every prospective company to give you their best rates. Some discounts might not be offered on policies everywhere. To locate insurance companies who offer free Dodge Challenger insurance quotes in Baltimore, click this link.

Coverage statistics and figures

The price information displayed next outlines estimates of insurance coverage prices for Dodge Challenger models. Knowing how insurance policy rates are figured can assist in making informed coverage decisions.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Challenger SE | $190 | $334 | $440 | $26 | $132 | $1,122 | $94 |

| Challenger R/T | $210 | $384 | $440 | $26 | $132 | $1,192 | $99 |

| Challenger SRT-8 | $230 | $434 | $440 | $26 | $132 | $1,262 | $105 |

| Get Your Own Custom Quote Go | |||||||

Table data represents married male driver age 50, no speeding tickets, no at-fault accidents, $1000 deductibles, and Maryland minimum liability limits. Discounts applied include safe-driver, multi-policy, multi-vehicle, claim-free, and homeowner. Estimates do not factor in vehicle garaging location which can change premiums greatly.

Does it make sense to buy full coverage?

The chart below illustrates the comparison of Dodge Challenger auto insurance rates with full coverage and liability only. The premiums assume a clean driving record, no at-fault accidents, $100 deductibles, marital status is single, and no discounts are applied.

When to stop paying for full coverage

There isn't a steadfast formula that works best for making the decision to drop full coverage, but there is a guideline you can use. If the yearly cost of full coverage is more than around 10% of the replacement cost minus the deductible, then it's probably a good time to buy liability coverage only.

For example, let's pretend your Dodge Challenger settlement value is $4,000 and you have $1,000 deductibles. If your vehicle is damaged in an accident, the most your company will settle for is $3,000 after you pay the deductible. If you are currently paying more than $300 a year for physical damage coverage, then it could be time to drop full coverage.

There are some circumstances where only buying liability is not financially feasible. If you haven't satisfied your loan, you have to maintain full coverage to protect the lienholder's interest. Also, if you don't have enough money to buy a different vehicle in the event your current vehicle is totaled, you should not opt for liability only.

Learn How to Lower Your Insurance Rates

The best way to find cheaper car insurance is to take a look at a few of the rating criteria that aid in calculating the rates you pay for car insurance. If you know what influences your rates, this enables you to make decisions that could result in better car insurance rates. Lots of things are used in the calculation when quoting car insurance. Most are fairly basic like a motor vehicle report, but other criteria are more transparent such as your marital status or your financial responsibility.

The following are some of the most common factors utilized by car insurance companies to help set prices.

- How credit score affects car insurance rates - Your credit score is a big factor in determining what you pay. If your credit score can be improved, you could save money insuring your Dodge Challenger if you clean up your credit. Consumers who have high credit ratings tend to be more responsible and file fewer claims than drivers who have lower credit scores.

-

Better drivers pay less - Drivers with clean records receive lower rates than their less careful counterparts. Having a single driving citation could increase your next policy renewal forty percent or more. Drivers who have received careless citations such as reckless driving or DUI may need to submit a SR-22 form with their state motor vehicle department in order to legally drive a vehicle.

The diagram below demonstrates how speeding tickets and at-fault claims increase Dodge Challenger car insurance rates for different insured age categories. The premium estimates are based on a single female driver, comp and collision included, $500 deductibles, and no discounts are applied.

- How much liability protection - A critical coverage on your policy, liability insurance kicks in when a jury decides you are liable for damages from an accident. Liability insurance provides legal defense to defend your case. This coverage is very inexpensive compared to insuring for physical damage coverage, so drivers should carry high limits.

- Big cities have higher costs - Residing in a rural area can be a good thing when buying car insurance. Less people living in that area translates into fewer accident claims. People who live in big cities have to deal with more aggressive driving styles and more severe claims. More time on the road means a statistically higher chance of an accident.

- Stay claim-free and lower prices - Car insurance companies in Maryland provide better rates to people that do not abuse their auto insurance. If you are a frequent claim filer, you can expect either a policy non-renewal or much higher rates. Your car insurance is intended for claims that you cannot pay yourself.

-

Insurance is expensive for teen drivers - Older people are shown to be more cautious, are lower risk to insure, and are safer drivers. Drivers with little experience are proven to get distracted easily when behind the wheel and because of this, their car insurance rates are much higher.

The data below uses these variables: single driver, full coverage with $500 deductibles, and no discounts or violations.