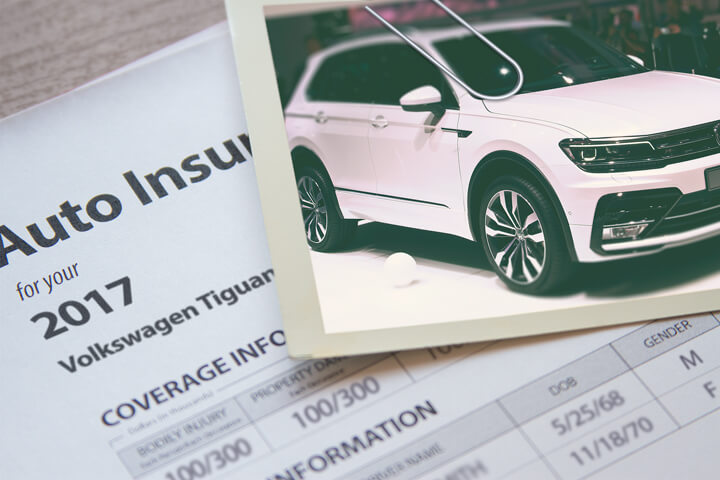

Volkswagen Tiguan insurance cost image courtesy of QuoteInspector.com

The best way to find more affordable Volkswagen Tiguan insurance is to regularly compare price quotes from different companies in Baltimore. Price quotes can be compared by following these guidelines.

First, read and learn about how companies set rates and the measures you can take to prevent high rates. Many risk factors that cause high rates like speeding tickets, careless driving and a poor credit score can be improved by making small lifestyle or driving habit changes. This article gives more ideas to get low prices and get additional discounts that may be available.

Second, request rate estimates from direct, independent, and exclusive agents. Direct and exclusive agents can give quotes from one company like GEICO or State Farm, while independent agents can quote rates from many different companies.

Third, compare the quotes to your existing rates to determine if switching companies saves money. If you find a lower rate, make sure there is no lapse in coverage.

The key aspect of shopping around is to make sure you enter the same level of coverage on each quote request and and to get quotes from all possible companies. Doing this helps ensure the most accurate price comparison and a complete price analysis.

It's hard to believe, but a large majority of consumers have been with the same company for at least the last four years, and about 40% of consumers have never even compared rates from other companies. Most drivers in Maryland can save nearly 55% each year, but they think it's difficult to compare other rate quotes.

It's hard to believe, but a large majority of consumers have been with the same company for at least the last four years, and about 40% of consumers have never even compared rates from other companies. Most drivers in Maryland can save nearly 55% each year, but they think it's difficult to compare other rate quotes.

The quickest method we recommend to compare rates for Volkswagen Tiguan insurance in Baltimore is to know car insurance companies allow for online access to provide you with free rate quotes. To start a quote, the only thing you need to do is provide a little information like if the car is leased, how old drivers are, if your license is active, and an estimate of your credit level. Those rating factors is sent automatically to multiple companies and they return rate quotes almost instantly.

To compare cheap Volkswagen Tiguan insurance rates now, click here and enter your coverage details.

The following companies are ready to provide free quotes in Maryland. If you want to find the best auto insurance in Baltimore, MD, it's highly recommended you get price quotes from several of them in order to find the cheapest rates.

Volkswagen Tiguan insurance charts and tables

The coverage table shown below showcases estimates of insurance coverage prices for Volkswagen Tiguan models. Understanding more about how insurance prices are calculated is important for you to make smart choices when buying a policy.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Tiguan S 2WD | $248 | $418 | $352 | $20 | $106 | $1,144 | $95 |

| Tiguan S 2WD | $248 | $418 | $352 | $20 | $106 | $1,144 | $95 |

| Tiguan SE 4Motion AWD | $280 | $492 | $352 | $20 | $106 | $1,250 | $104 |

| Tiguan SEL 4Motion AWD | $280 | $492 | $352 | $20 | $106 | $1,250 | $104 |

| Get Your Own Custom Quote Go | |||||||

Data variables include married female driver age 30, no speeding tickets, no at-fault accidents, $500 deductibles, and Maryland minimum liability limits. Discounts applied include homeowner, multi-vehicle, claim-free, multi-policy, and safe-driver. Estimates do not factor in zip code location which can alter coverage prices substantially.

Comparison of auto insurance rates by gender and age in Baltimore

The example below illustrates the difference between Volkswagen Tiguan insurance costs for male and female drivers. Data assumes no accidents, no driving violations, comp and collision included, $100 deductibles, marital status is single, and no policy discounts are applied.

You are unique and your auto insurance should be too

Always remember that when buying adequate coverage, there really is no cookie cutter policy. Coverage needs to be tailored to your specific needs.

For example, these questions can aid in determining whether your personal situation will benefit from professional help.

- Can good grades get a discount?

- Is there coverage for my trailer?

- If I drive on a suspended license am I covered?

- Should I get collision insurance on every vehicle?

- Why am I be forced to buy a membership to get insurance from some companies?

- Are all vehicle passengers covered by medical payments coverage?

- Why are teen drivers so expensive to add on to my policy?

- Do I have coverage when making deliveries for my home business?

If it's difficult to answer those questions but you know they apply to you then you might want to talk to an insurance agent. If you want to speak to an agent in your area, take a second and complete this form.

Exclusive versus independent insurance agents

Some people prefer to talk to a local agent and that is just fine! One of the best bonuses of comparing car insurance online is the fact that you can find better rates but also keep your business local. Putting coverage with neighborhood insurance agencies is definitely important in Baltimore.

Once you complete this simple form, the quote information is transmitted to local insurance agents who will give you bids for your insurance coverage. It simplifies rate comparisons since you won't have to visit any agencies since price quotes are sent to your email. You can find the lowest rates without requiring a lot of work. If you wish to get a price quote from one company in particular, you would need to visit that company's website and fill out the quote form the provide.

Once you complete this simple form, the quote information is transmitted to local insurance agents who will give you bids for your insurance coverage. It simplifies rate comparisons since you won't have to visit any agencies since price quotes are sent to your email. You can find the lowest rates without requiring a lot of work. If you wish to get a price quote from one company in particular, you would need to visit that company's website and fill out the quote form the provide.

If you would like to find a reputable agency, it's helpful to know the types of insurance agents and how they work. Insurance agencies in Baltimore can be described as either independent agents or exclusive agents.

Independent Insurance Agents

Agents in the independent channel do not write with just one company so they can write business with multiple insurance companies depending on which coverage is best. To transfer your coverage to a different company, the agent simply finds a different carrier and you don't have to find a new agent.

When comparing car insurance rates, you absolutely need to get several quotes from several independent insurance agents to have the best price comparison.

The following is a partial list of independent insurance agencies in Baltimore that may be able to provide rate quotes.

Morgan Smith Insurance Agency

847 W 36th St - Baltimore, MD 21211 - (410) 889-9290 - View Map

Nationwide Insurance: Bruce Cohee Agency Inc

502 Baltimore Ave - Towson, MD 21204 - (410) 823-8777 - View Map

Concrete Insurance

6405 Belair Rd - Baltimore, MD 21206 - (410) 433-0313 - View Map

Exclusive Insurance Agencies

These type of agents can only provide pricing for a single company such as State Farm, Allstate, and Farm Bureau. Exclusive agents cannot place coverage with different providers so always compare other rates. Exclusive agents receive extensive training in insurance sales and that allows them to sell at a higher price point.

The following is a list of exclusive insurance agencies in Baltimore who can help you get price quotes.

David Rosario - State Farm Insurance Agent

3121 Eastern Ave - Baltimore, MD 21224 - (410) 850-4949 - View Map

Aja Green - State Farm Insurance Agent

7635 Belair Rd - Baltimore, MD 21236 - (410) 882-9433 - View Map

Allstate Insurance: Shanda Hayden

7200 Eastern Ave a - Baltimore, MD 21224 - (410) 282-7863 - View Map

Finding the right insurance agency shouldn't rely on just a cheap price. The questions below may impact your decision as well.

- In the event of vehicle damage, can you pick the collision repair facility?

- Will their companies depreciate repairs to your car based on the mileage?

- What insurance companies do they work with in Baltimore?

- Do they specialize in personal lines coverage in Baltimore?

- Is the agent CPCU or CIC certified?

- Is the agent properly licensed in Maryland?

- How many years of experience in personal auto insurance do they have?

- What company do they have the most business with?

If you receive reasonable responses in addition to an acceptable price estimate, it's possible that you found an insurance agency that can be relied on to adequately provide car insurance.