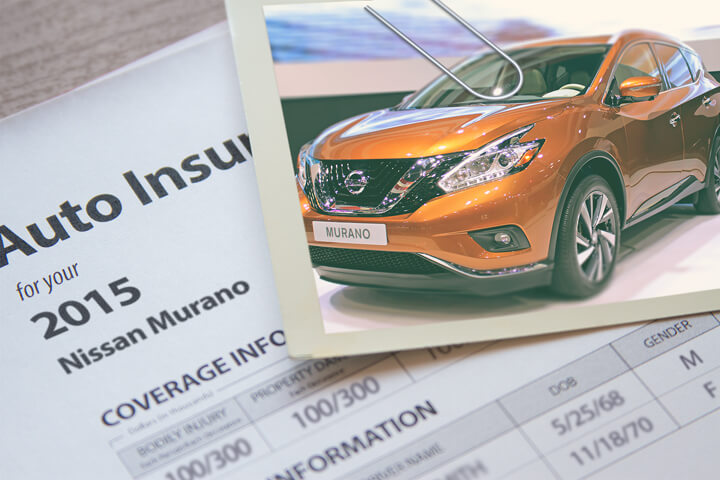

Nissan Murano insurance cost image courtesy of QuoteInspector.com

If saving money is your primary concern, then the best way to save on Nissan Murano insurance in Baltimore is to start comparing prices yearly from different companies that insure vehicles in Maryland. You can compare prices by following these steps.

If saving money is your primary concern, then the best way to save on Nissan Murano insurance in Baltimore is to start comparing prices yearly from different companies that insure vehicles in Maryland. You can compare prices by following these steps.

- Learn about the different coverages in a policy and the factors you can control to prevent rate increases. Many things that are responsible for high rates like traffic violations, accidents, and a low credit score can be amended by improving your driving habits or financial responsibility.

- Compare rates from independent agents, exclusive agents, and direct companies. Direct and exclusive agents can give quotes from one company like Progressive and State Farm, while independent agents can provide rate quotes for many different companies.

- Compare the new quotes to the price on your current policy to see if switching to a new carrier will save money. If you find a lower rate quote, ensure coverage does not lapse between policies.

The most important part of shopping around is that you'll want to make sure you compare the same deductibles and limits on every quote and and to compare as many companies as you can. This ensures a fair rate comparison and the best rate selection.

It's well known that insurance companies want to keep you from shopping around. Consumers who get price comparisons will most likely switch to a new company because there is a good chance of getting low-cost coverage. A recent auto insurance study revealed that consumers who routinely shopped around saved $72 a month compared to those who never compared rates.

If finding budget-friendly car insurance in Baltimore is your ultimate goal, then having some insight into how to shop for coverage rates can make it easier to shop your coverage around.

Finding a better price on car insurance is surprisingly easy. The only thing you need to do is take a couple of minutes comparing rate quotes from different insurance companies.

Getting free rate quotes online is quite simple, and it takes the place of having to physically go to different Baltimore agent offices. The fact that you can get quotes online eliminates this option unless you prefer the extra assistance that can only be provided by a licensed insurance agent. You can, however, comparison shop online but purchase the actual policy in an agency.

The companies shown below offer quotes in Maryland. If multiple companies are listed, it's highly recommended you visit several of them to get a more complete price comparison.

Auto insurance analysis for a Nissan Murano

The premium table shown below outlines detailed analysis of rate quotes for Nissan Murano models. Being more informed about how insurance prices are determined can help customers make informed decisions when shopping around for a new policy.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Murano S 2WD | $272 | $536 | $390 | $24 | $116 | $1,338 | $112 |

| Murano S AWD | $272 | $536 | $390 | $24 | $116 | $1,338 | $112 |

| Murano SL 2WD | $272 | $536 | $390 | $24 | $116 | $1,338 | $112 |

| Murano SL AWD | $272 | $536 | $390 | $24 | $116 | $1,338 | $112 |

| Murano LE 2WD | $308 | $632 | $390 | $24 | $116 | $1,470 | $123 |

| Murano LE AWD | $308 | $632 | $390 | $24 | $116 | $1,470 | $123 |

| Get Your Own Custom Quote Go | |||||||

Price data assumes married male driver age 50, no speeding tickets, no at-fault accidents, $100 deductibles, and Maryland minimum liability limits. Discounts applied include homeowner, safe-driver, multi-vehicle, claim-free, and multi-policy. Information does not factor in the specific area where the vehicle is garaged which can modify prices substantially.

Policy deductible comparison

When buying auto insurance, a common question is where to set your physical damage deductibles. The rates shown below sum up the differences in premium rates of buying low and high deductibles. The first rate comparisons uses a $250 comprehensive and collision deductible and the second set of prices uses a $500 deductible.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Murano S 2WD | $314 | $528 | $406 | $24 | $122 | $1,419 | $118 |

| Murano S AWD | $314 | $528 | $406 | $24 | $122 | $1,419 | $118 |

| Murano SL 2WD | $314 | $528 | $406 | $24 | $122 | $1,419 | $118 |

| Murano SL AWD | $314 | $528 | $406 | $24 | $122 | $1,419 | $118 |

| Murano LE 2WD | $354 | $624 | $406 | $24 | $122 | $1,555 | $130 |

| Murano LE AWD | $354 | $624 | $406 | $24 | $122 | $1,555 | $130 |

| Get Your Own Custom Quote Go | |||||||

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Murano S 2WD | $256 | $426 | $406 | $24 | $122 | $1,234 | $103 |

| Murano S AWD | $256 | $426 | $406 | $24 | $122 | $1,234 | $103 |

| Murano SL 2WD | $256 | $426 | $406 | $24 | $122 | $1,234 | $103 |

| Murano SL AWD | $256 | $426 | $406 | $24 | $122 | $1,234 | $103 |

| Murano LE 2WD | $288 | $502 | $406 | $24 | $122 | $1,342 | $112 |

| Murano LE AWD | $288 | $502 | $406 | $24 | $122 | $1,342 | $112 |

| Get Your Own Custom Quote Go | |||||||

Table data assumes married male driver age 30, no speeding tickets, no at-fault accidents, and Maryland minimum liability limits. Discounts applied include claim-free, safe-driver, multi-vehicle, multi-policy, and homeowner. Rates do not factor in zip code location which can impact coverage rates significantly.

Based on this data, using a $250 deductible could cost the average driver approximately $16 more each month or $192 each year than selecting the higher $500 deductible. Since you would pay $250 more if you file a claim with a $500 deductible as compared to a $250 deductible, if you tend to have at a minimum 16 months between claim filings, you would probably come out ahead if you choose the higher deductible.

The illustration below demonstrates how deductible levels and can raise or lower Nissan Murano insurance prices for each different age group. The price estimates are based on a single female driver, comp and collision included, and no discounts are factored in.

Comparison of full coverage and liability-only policies

The illustration below shows the comparison of Nissan Murano annual premium costs with full physical damage coverage compared to only buying the minimum liability limits required in Maryland. The rates are based on no violations or claims, $1,000 deductibles, marital status is single, and no discounts are applied to the premium.

Should you pay for full coverage or liability only?

There is no written rule for dropping comp and collision coverage, but there is a general guideline. If the annual cost of coverage is about 10% or more of the replacement cost minus the deductible, then you may want to consider only buying liability coverage.

For example, let's say your Nissan Murano replacement cost is $7,000 and you have $1,000 deductibles. If your vehicle is totaled, you would only receive $6,000 after paying your policy deductible. If premiums are more than $600 annually to have full coverage, then you might consider buying liability only.

There are some cases where dropping full coverage is not in your best interest. If you still owe a portion of the original loan, you have to maintain full coverage as part of the loan conditions. Also, if your emergency fund is not enough to purchase a different vehicle if your current one is damaged, you should not opt for liability only.

Check for these nine discounts on Nissan Murano insurance in Baltimore

Auto insurance companies don't always advertise the entire discount list very clearly, so here is a list both the well known and the harder-to-find credits available to you. If you do not double check each discount possible, you are throwing money away.

- Good Grades Discount - Being a good student can earn a discount of 20% or more. You can use this discount normally well after school through age 25.

- Defensive Driver Discounts - Successfully completing a driver safety class could earn you a small percentage discount depending on where you live.

- New Car Discount - Buying a new car instead of a used Murano is cheaper since newer vehicles have better safety ratings.

- Telematics Data - Policyholders that allow driving data submission to track when and where they use their vehicle remotely such as Allstate's Drivewise and State Farm's In-Drive system might get better premium rates as long as the data is positive.

- Active Military Service - Being deployed in the military can result in better car insurance rates.

- Federal Government Employee - Employees or retirees of the government can earn a discount up to 10% but check with your company.

- Discounts for Multiple Vehicles - Drivers who insure primary and secondary vehicles on one policy may reduce the rate for each vehicle.

- Accident Waiver - Not necessarily a discount, but a handful of insurance companies will turn a blind eye to one accident without the usual rate increase if you have no claims prior to being involved in the accident.

- Drive Safe and Save - Drivers who don't get into accidents can pay as much as 50% less than their less cautious counterparts.

A little note about advertised discounts, many deductions do not apply to the entire cost. Some only apply to the cost of specific coverages such as physical damage coverage or medical payments. Despite the fact that it seems like you would end up receiving a 100% discount, companies wouldn't make money that way.

The diagram below illustrates the comparison of Nissan Murano yearly insurance costs with and without discounts applied. The data is based on a male driver, no driving violations, no at-fault accidents, Maryland state minimum liability limits, comp and collision included, and $250 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with multi-car, homeowner, marriage, multi-policy, safe-driver, and claim-free discounts applied.

For a list of car insurance companies that offer some of these discounts in Maryland, click this link.

Why you need Nissan vehicle insurance in Maryland

Despite the high cost, buying car insurance is mandatory in Maryland but it also protects more than you think.

- The majority of states have mandatory liability insurance requirements which means state laws require a minimum amount of liability insurance coverage in order to drive the car legally. In Maryland these limits are 30/60/15 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $15,000 of property damage coverage.

- If your Murano has a loan, it's most likely the lender will stipulate that you buy insurance to guarantee loan repayment. If you default on your policy, the bank or lender will purchase a policy for your Nissan for a lot more money and force you to pay the higher premium.

- Insurance protects both your Nissan Murano and your assets. It will also pay for medical transport and hospital expenses for yourself as well as anyone injured by you. Liability insurance, one of your policy coverages, will also pay to defend you if someone files suit against you as the result of an accident. If your car is damaged in a storm or accident, your policy will pay to have it repaired.

The benefits of carrying adequate insurance are definitely more than the cost, especially if you ever need it. As of last year, the average driver in Maryland overpays more than $750 every year so you should quote and compare rates at least once a year to save money.

When do I need an agent's advice?

Always keep in mind that when comparing adequate coverage for your personal vehicles, there really isn't a best way to insure your cars. Your needs are unique to you.

These are some specific questions could help you determine if your insurance needs will benefit from professional help.

- Will filing a claim cost me more?

- How high should my medical payments coverage be?

- Does medical payments coverage apply to all occupants?

- Will my insurance pay for OEM parts?

- Am I covered by my employer's commercial auto policy when driving my personal car for business?

- Does my personal policy cover me when driving out-of-state?

- How can I find cheaper teen driver insurance?

- Do I have coverage if my license is suspended?

If you can't answer these questions but you think they might apply to your situation then you might want to talk to an insurance agent. If you don't have a local agent, take a second and complete this form. It is quick, free and may give you better protection.

Local neighborhood insurance agents

A small number of people just want to get advice from a local agent and that is a personal choice. Insurance agents can make sure you are properly covered and will help you if you have claims. The best thing about comparing insurance prices online is the fact that you can find cheap rate quotes and still choose a local agent. And buying from local agents is important especially in Baltimore.

After filling out this form (opens in new window), the coverage information is instantly submitted to local insurance agents who will give you bids for your auto insurance coverage. There is no need to contact an agency because quoted prices will be sent directly to your email. If you wish to get a price quote from a specific auto insurance provider, don't hesitate to search and find their rate quote page to submit a rate quote request.

Baltimore car insurance agents are either independent or exclusive

When narrowing the list to find a local Baltimore insurance agent, you must know there are a couple different types of agents and how they can service your needs differently. Auto insurance agencies can be classified as either exclusive agents or independent agents. Both types can insure your vehicles, but we need to point out how they differ because it can factor into which type of agent you select.

Independent Insurance Agents

Agents of this type can sell policies from many different companies and that is an advantage because they can write policies with an assortment of companies and find you the best rates. If they find a cheaper price, the business is moved internally and the insured can keep the same agent. When comparison shopping, we highly recommend that you get quotes from at least one independent agent to get the most accurate price comparison.

Listed below are independent agents in Baltimore that may be able to provide price quotes.

Mason and Carter Inc

23 South St - Baltimore, MD 21202 - (410) 539-6767 - View Map

Nationwide Insurance: Bruce Cohee Agency Inc

502 Baltimore Ave - Towson, MD 21204 - (410) 823-8777 - View Map

Upper Chesapeake Insurance Agency Inc

900 S Charles St - Baltimore, MD 21230 - (410) 385-0455 - View Map

Exclusive Auto Insurance Agencies

Exclusive agents work for only one company and some examples include AAA, State Farm, Farmers Insurance, and Allstate. They are unable to place coverage with different providers so they have no alternatives for high prices. They receive a lot of sales training on their company's products and that enables them to sell even at higher rates.

The following are Baltimore exclusive insurance agents that can give you comparison quotes.

Joe Lawton - State Farm Insurance Agent

9008 Harford Rd - Baltimore, MD 21234 - (410) 665-0243 - View Map

John Stein - State Farm Insurance Agent

6630 Baltimore National Pike #100b - Baltimore, MD 21228 - (410) 744-7733 - View Map

Aja Green - State Farm Insurance Agent

7635 Belair Rd - Baltimore, MD 21236 - (410) 882-9433 - View Map

Choosing the best car insurance agent requires more thought than just the quoted price. The questions below may impact your decision as well.

- Is vehicle damage repaired with OEM or aftermarket parts?

- Is the agent CPCU or CIC certified?

- Will the company cover a rental car if your car is getting fixed?

- Will you be dealing directly with the agent or with a Custom Service Representative (CSR)?

- What are their preferred companies if they are an independent agency?

After receiving reasonable responses to any questions you may have as well as the cheapest Nissan Murano insurance in Baltimore quotes, it's a good possibility that you have found an insurance agent that is reliable enough to service your policy. Just understand that policyholders can cancel your policy whenever you wish so don't think that you are obligated to the auto insurance policy for the full policy term.

Auto insurance coverages

Understanding the coverages of your policy can be of help when determining which coverages you need and the correct deductibles and limits. Car insurance terms can be ambiguous and reading a policy is terribly boring.

Liability coverages

This coverage protects you from injuries or damage you cause to a person or their property by causing an accident. It consists of three limits, bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. You might see values of 30/60/15 which stand for $30,000 bodily injury coverage, $60,000 for the entire accident, and $15,000 of coverage for damaged property. Occasionally you may see one number which is a combined single limit that pays claims from the same limit with no separate limits for injury or property damage.

Liability insurance covers claims like structural damage, loss of income, funeral expenses, medical expenses and legal defense fees. How much liability coverage do you need? That is a personal decision, but it's cheap coverage so purchase higher limits if possible. Maryland state law requires minimum liability limits of 30/60/15 but drivers should carry more liability than the minimum.

The illustration below shows why buying minimum limits may not be high enough to cover claims.

Collision insurance

Collision coverage pays to fix your vehicle from damage resulting from a collision with another vehicle or an object, but not an animal. You first must pay a deductible then your collision coverage will kick in.

Collision coverage protects against claims like hitting a parking meter, rolling your car, sustaining damage from a pot hole and damaging your car on a curb. Collision is rather expensive coverage, so consider removing coverage from older vehicles. You can also bump up the deductible on your Murano to save money on collision insurance.

Comprehensive coverage

This will pay to fix damage that is not covered by collision coverage. You first have to pay a deductible and then insurance will cover the rest of the damage.

Comprehensive coverage pays for things such as hitting a deer, damage from getting keyed, a broken windshield and hail damage. The highest amount you can receive from a comprehensive claim is the ACV or actual cash value, so if your deductible is as high as the vehicle's value it's probably time to drop comprehensive insurance.

Uninsured/Underinsured Motorist coverage

Your UM/UIM coverage protects you and your vehicle's occupants from other motorists when they either are underinsured or have no liability coverage at all. Covered losses include hospital bills for your injuries and also any damage incurred to your Nissan Murano.

Since a lot of drivers only carry the minimum required liability limits (Maryland limits are 30/60/15), it only takes a small accident to exceed their coverage. So UM/UIM coverage should not be overlooked. Most of the time the UM/UIM limits do not exceed the liability coverage limits.

Medical payments coverage and PIP

Coverage for medical payments and/or PIP reimburse you for short-term medical expenses such as ambulance fees, doctor visits, nursing services, prosthetic devices and EMT expenses. They are often used to fill the gap from your health insurance plan or if there is no health insurance coverage. It covers not only the driver but also the vehicle occupants as well as being hit by a car walking across the street. PIP coverage is not an option in every state and gives slightly broader coverage than med pay